What’s New

Where Have All the Economists Gone?

The Bureau of Labor Statistics says there are 18,650 economists in the United States. You have to wonder what they are all doing? No one is better qualified to comment on the economic effects of public policies than economists. Yet, only a handful of them routinely do so. Instead, they yield the public square to non-economists who are only too happy to fill the void and whose opinions are often wrong.

“Where Have All the Economists Gone?” asks John Goodman. In four separate editorials on socialism, racism, taxes and the environment, Goodman says economists who have a lot to say are holding back while too much nonsense dominates the public policy discussion.

Savings and Gramm: How the Fed is Slowing Monetary Growth

The Federal Reserve is buying Treasury bills and mortgage-backed securities at a rate of $120 billion a month. This is apparently being done to support large borrowing by the federal government. At the same time, the Fed has pulled almost a trillion dollars of liquidity out of the financial system by “reverse-repo borrowing.” This has reduced bank reserves and private sector lending. Not surprisingly, the growth of the M2 money stock fell from around 25% in 2020 to around 10% on an annualized basis in the first six months of 2021.

Study: Inequality Greatly Exaggerated

Lifetime spending inequity is one-third of wealth inequality. The main reason: government taxes and transfers, which make the system far more “progressive than we are led to believe. In 2018, for example, the top 1 percent of taxpayers paid 40.1 percent of all federal income taxes. The top 10 percent paid 71.4 percent. The bottom half of the country paid less than 3 percent of all federal income taxes.

With Obamacare Still on Books, Americans in Dire Need of Better Insurance Options

The solution to Obamacare’s high out-of-pocket costs and narrow networks is to let people buy insurance that meets their medical and financial needs. That’s why people are turning to short-term insurance, limited benefit insurance and health sharing insurance.

SCOTUS Punts Obamacare Back to Congress

Obamacare has two very bad features: unaffordable out-of-pocket costs and perilously narrow networks. If you combine last year’s average (unsubsidized) premium with the average deductible, a family of four had to pay $25,000 before getting any benefits at all from their plan. Also, the average plan looks like Medicaid managed care with a high deductible, excluding access to the best doctors and the best hospitals.

Mark Cuban’s Health Plan

Dallas Mavericks owner Mark Cuban has done some innovative thinking on how to reform the health care system. The Cuban plan is similar to an idea once proposed by Milton Friedman and also by Harvard economist Martin Feldstein. In a nutshell, people would be responsible for medical bills up to a certain percent of their income, and government would pay everything above that. In other words, people would pay ordinary bills out-of-pocket, and government would provide catastrophic coverage for the large bills.

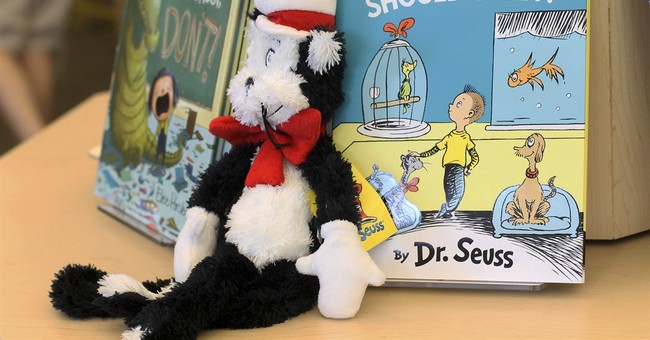

How Did the Cancel Culture Become So Dominant So Quickly?

The intellectual collapse of liberalism and conservatism at the end of the 20th century created space that the cancel culture moved quickly to occupy. The world of ideas abhors a vacuum. Absent the traditions bequeathed to us by the Enlightenment and the Age of Reason, the cancel culture was only too willing to serve up irrationality and unreason.

Who Pays the Corporate Income Tax?

What about Joe Biden’s promise that the next big spending bill won’t cost anyone a dime if they make less than $400,000? All economists think that the corporate income tax is partly paid for by lower wages for workers. The only question is: How much of the cost is born by labor? Larry Kotlikoff and his colleagues, using the most sophisticated model of international financial flows that exists, have concluded that the full burden of the corporate income tax falls on workers. Not just in this country. But in every country. The editorial board of the says they agreed with him.

How to Reform Obamacare

John Goodman was the first person to note that health plans would respond to Obamacare incentives by imposing high deductibles (three times what is normal for employer plans) and narrow networks (as bad or worse than under Medicaid). Along with Boston University economist Laurence Kotlikoff, he has now proposed simple, straightforward reforms to both problems in an editorial published in the Hill.

Minimum Wage

Suppose Congress were considering a bill that would do the following: either your employer must double your wage or fire you. Is that the kind of law you would like to see passed? Most people wouldn’t. But then why are they willing to inflict the same threatening edict on those at the bottom of the income ladder?