Resolved:

The United States federal government should substantially increase fiscal redistribution in the United States by adopting a federal jobs guarantee, expanding Social Security, and/or providing a basic income.

Articles on Economic Inequality

John Goodman grew up in Waco, TX and participated in high school debate competitions around the state of Texas. John was quite successful and won several statewide tournaments. He attended college at the University of Texas in Austin, where he became involved in campus politics and was elected vice president of the student body. All of this experience served him later in life when he became a TV debating partner of conservative polemicist William F. Buckley.

John Goodman grew up in Waco, TX and participated in high school debate competitions around the state of Texas. John was quite successful and won several statewide tournaments. He attended college at the University of Texas in Austin, where he became involved in campus politics and was elected vice president of the student body. All of this experience served him later in life when he became a TV debating partner of conservative polemicist William F. Buckley.

A Short Primer on Economic Growth

It is an economic truism that capital is needed to make investments which are a prerequisite for increasing worker productivity, which is a prerequisite for raising the average income of workers. That is to say, capital is essential for economic growth. Economic growth is the most powerful anti-poverty weapon ever discovered. So consuming capital today makes poor people poorer in future years. Some might question whether economic growth is unambiguously good. This post contains two short videos explaining why growth is unquestionably good – everywhere in the world.

Welfare without Work

The most contentious issue regarding income support for the bottom of the income ladder has to do with work.

As previously noted, the Earned Income Tax Credit and the Child Tax Credit, although largely Republican creations, have broad support in Congress from both political parties.

A Goodman Institute study shows that by 2018, if a mother worked full time at the minimum wage, it was impossible for the family to be poor – regardless of the number of children. That conclusion is even more true today, since the average wage for unskilled (and moderately skilled) workers is more than twice the minimum wage, nationwide.

How Lotteries Create Inequality

There is no single act of government that creates more inequality in a shorter amount of time than the lottery. Tickets are mainly purchased by below-average income buyers, and then the winner becomes fabulously wealthy.

Surprisingly, this activity is rarely criticized by “progressives.”

The largest lottery winner in history walked away with an estimated $2.04 billion Powerball jackpot.

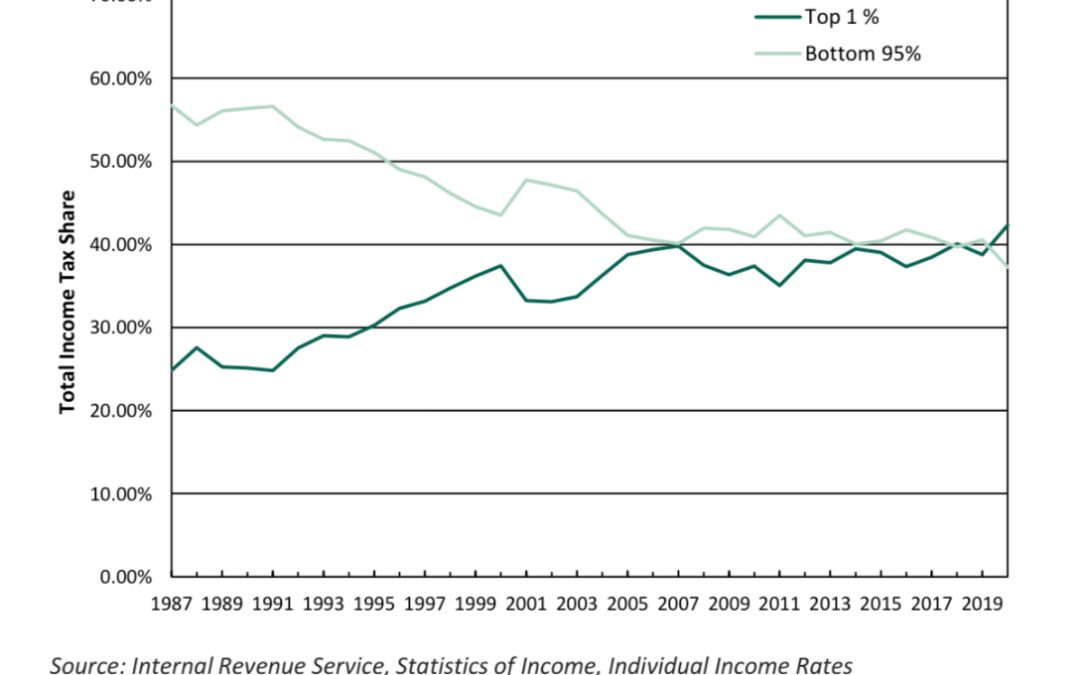

How Progressive is the Income Tax?

The latest IRS statistics tell the story. The richest one out of 100 Americans now pay more in federal income taxes than the bottom 95 out of 100. There is almost no country in the world that relies on the top 1% to pay a larger share of the tax burden than the United States. Notice that the tax share of the top 1% went UP after the Trump tax cuts.

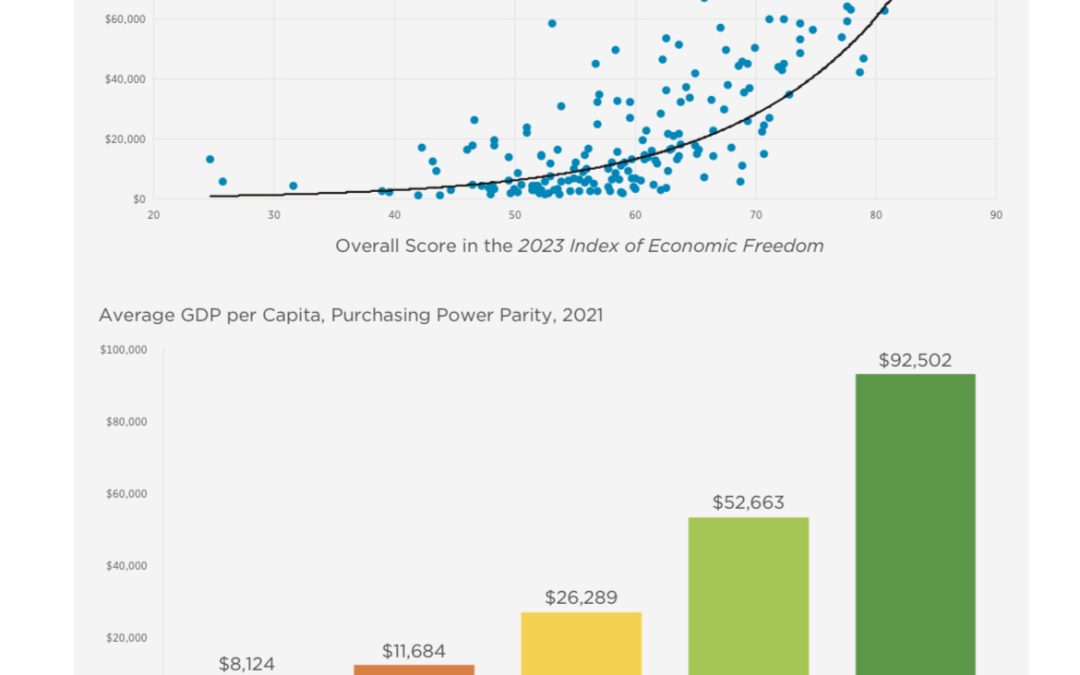

Why are Some Nations Rich and Others Poor?

The Heritage Foundation has just issued its indispensable international Index of Economic Freedom for 2023. This chart shows the powerful correlation between freedom and growth.

Countries that are mostly free are 10 times richer per person than the most socialistic nations and three times richer than nations with average freedom. Economic freedom had been trending upward over the last two decades, but since COVID hit, freedom has fallen – and so has economic growth.

Economic Growth is the Most powerful Anti-Poverty Program Ever Discovered

For the last 50 years real income per person in the United States has grown at a rate of about 2.3% per year. If that 2.3% growth rate continues, then in fewer than 400 years, your descendants will earn about $1 million per day on the average — a little less than Bill Gates’ current income, but at least in the ballpark.

What about poverty? If we roughly define the poverty level as a family with 50% of the average income, then the level for the great-grandchildren of today’s poor will be $200,000. In other words, if tomorrow’s poor have a poverty-level income, they’ll be rich. And, of course, 400 years from now they’ll be fabulously wealthy. More