Resolved:

The United States federal government should substantially increase fiscal redistribution in the United States by adopting a federal jobs guarantee, expanding Social Security, and/or providing a basic income.

Articles on Economic Inequality

John Goodman grew up in Waco, TX and participated in high school debate competitions around the state of Texas. John was quite successful and won several statewide tournaments. He attended college at the University of Texas in Austin, where he became involved in campus politics and was elected vice president of the student body. All of this experience served him later in life when he became a TV debating partner of conservative polemicist William F. Buckley.

John Goodman grew up in Waco, TX and participated in high school debate competitions around the state of Texas. John was quite successful and won several statewide tournaments. He attended college at the University of Texas in Austin, where he became involved in campus politics and was elected vice president of the student body. All of this experience served him later in life when he became a TV debating partner of conservative polemicist William F. Buckley.

Are We Paying People to be Poor?

This is a potential weakness in all affirmative proposals.

Prior to the War on Poverty (1964), the level of poverty in the US steadily fell as national income rose. However, after the War on Poverty began, the official poverty rate hovered around 13% of the population for the next 60 years.

Writing the Cato journal, James Gwartney and Thomas McCaleb identified four reasons…

Correcting the Record

- New research by Gerald Auten of the US Treasury Department and David Splinter of the congressional Joint Committee on Taxation finds that the after-tax income share of the top 1% has barely changed since 1962. More.

- Is it true that 1 in 8 American households are so poor that someone must skip a meal each month to get by? No, it is not—the real number is more like 1 in 50. More.

- Biden: The expanded child tax credit “cut child poverty in half in 2021.” Proper modeling: expanded CTC alone would have reduced the child poverty rate to 8.3 percent in 2021. More.

- The left-leaning Center for Budget Policies says we need housing subsidies because of market failure in the housing market. In fact, public housing subsidies are anti-marriage: Per HUD data, only 3% of subsidized housing serves “two adults with children.” More.

New Results on Inequality

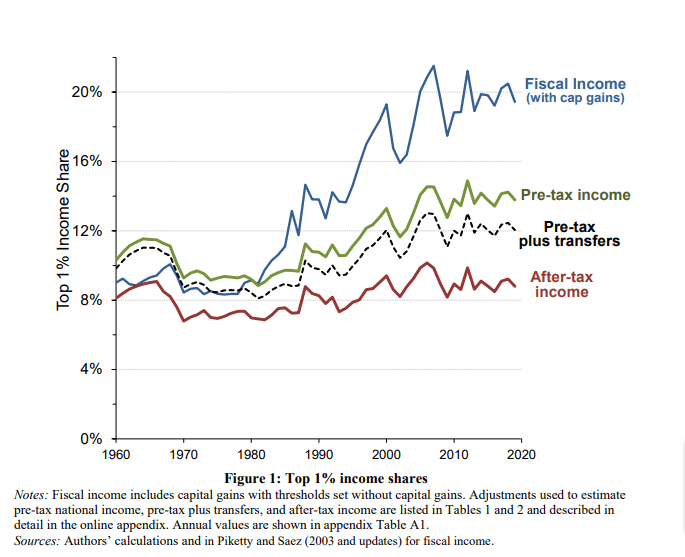

The Piketty-Saez-Zucman estimates show a substantial increase in the share of national income going to the top 1% of income earners. But these estimates ignore government taxes and transfer payments.

Yet a new study finds that the share of after-tax income earned by the top 1% has not changed since the 1960s.

Winning Ideas for High School Debate

Resolved: The United States federal government should substantially increase fiscal redistribution in the United States by adopting a federal jobs guarantee, expanding Social Security, and/or providing a basic income.

Why Two Parents Matter

Families headed by single mothers are five times as likely to live in poverty as married-couple families. Children in single-mother homes are less likely to graduate from high school or earn a college degree. They are more likely to become single parents themselves,...

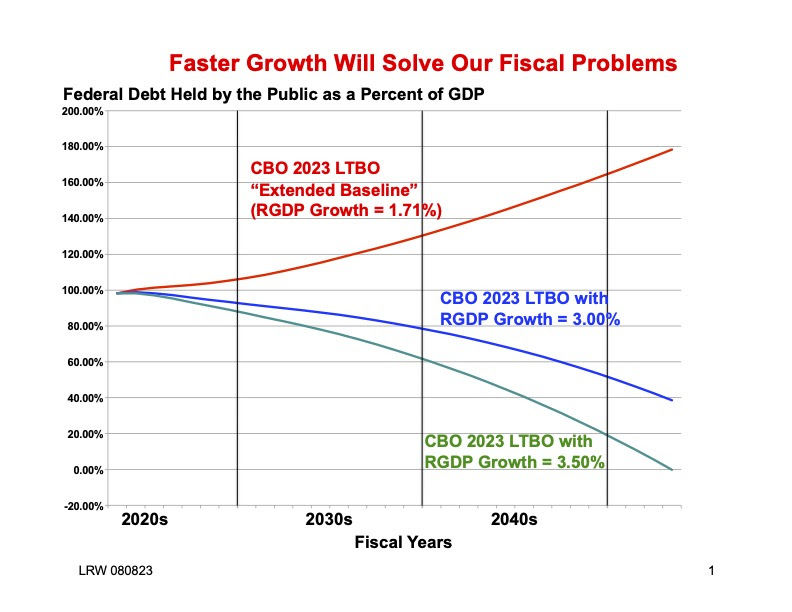

More on Economic Growth

If no policies are changed, in just ten years 66 million Social Security beneficiaries will see their monthly benefit checks cut by 23 percent. That will be financially devastating for retirees at the bottom of the income ladder – who depend on Social Security for their entire income – and it will double the number of seniors in poverty.

At the same time Medicare payments to hospitals will be automatically cut by 10 percent. That will make seniors, especially low-income seniors, less attractive as patients and lead to rationing of medical care.

As time passes, these financial problems will become increasingly worse. They will spill over and affect every social insurance program – Medicaid, food stamps, housing subsidies, etc.