- John Goodman

- Larry Kotlikoff

- Jane Shaw Stroup

- Thomas Saving

- Devon Herrick

- Linda Gorman

- Pete Du Pont

- All Posts

What Are We Getting for All That Obamacare Spending?

Obamacare spending has now reached $214 billion a year, insuring people through Medicaid (which is mostly contracted out to private insurers) and the Obamacare exchanges. At $1,731 for every household in America, that’s a great deal of money being transferred from taxpayers to insurance companies every year.

So, what are we getting in return?

One scholarly study finds there has been no overall increase in health care utilization in the U.S. since the enactment of Obamacare. The number of doctor visits per capita actually fell over the last decade.

See my latest post at Forbes.

Can We Reduce Health Care Costs with Better Primary Care?

A typical doctor’s office is quite spartan. The seating is usually austere. The flooring is low-budget (if there is carpeting, it is probably worn). And there are no free drinks or free food. If there is a restroom, it is probably located somewhere else in the building. More.

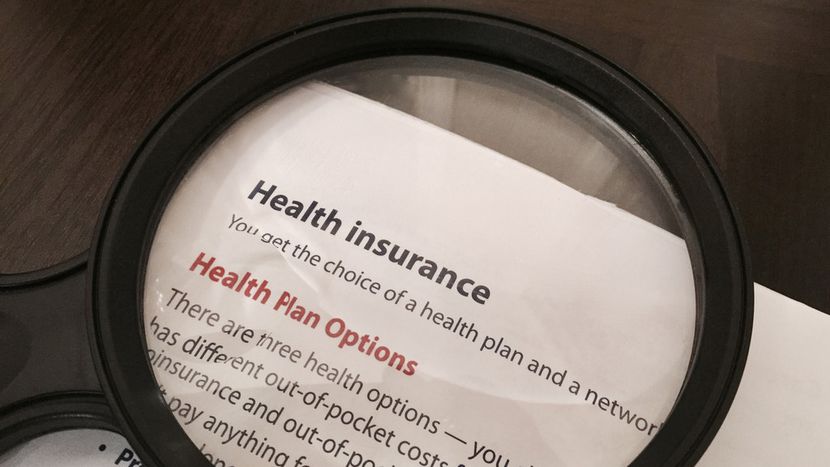

Washington Doesn’t understand Obamacare

In the House of Representatives, the GOP’s “number-one priority for health care reform” is lowering health insurance premiums. However, the vast majority of folks who buy their own insurance are getting hefty subsidies. So much so, that 8 in 10 enrollees in the exchanges pay $10 a month or less. For a family with average income, the premium is usually zero. More.

ObamaCare still desperately needs fixing

The American Rescue Plan injects new life into ObamaCare with more generous subsidies, expanded eligibility and premium limits that make insurance more affordable. Unfortunately, the stimulus proposal just passed by Congress does nothing to correct the most serious...

Our Tattered Health Care Safety Net

We are probably as close to universal health insurance as we are ever likely to be. Yet we are doing a poor job of delivering care to families at the bottom of the income ladder. These families find that as their income goes up and down and as their job opportunities ebb and flow, they bounce back and forth among eligibility for Medicaid, eligibility for subsidized insurance in the Obamacare exchanges, eligibility for employer-provided coverage and sometimes eligible for none of the above. More.

ObamaCare Turns Out to Be Affordable Only for the Healthy

It was supposed to help those with pre-existing conditions, but they pay dearly for bad options.

Obamacare’s Dirty Little Secret

When Democrats passed the Affordable Care Act of 2010, President Obama and lawmakers made the same claim over and over: The act would make good, affordable health insurance available to people with pre-existing conditions. The actual result has been the opposite. Obamacare makes health insurance as good as possible for the healthy and as bad as possible for the sick.

From John Goodman’s editorial in the Wall Street Journal (Paid gateway)

Can the Left and Right Agree on Health Reform?

A new book calls for universal health insurance coverage, but with no increase in government spending. It’s getting a lot of attention in progressive circles. Yet a bill that would go a long way toward implementing Finkelstein’s proposal has been introduced in Congress by a conservative Republican. More

Is There a Trump Health Care Plan?

Although he rarely talks about it, the most significant gift Donald Trump bequeathed to economic prosperity was deregulation. And the one sector that was deregulated more than any other was health care. Since Joe Biden has been re-regulating the economy, it’s hard to think of a starker contrast between the two leading presidential candidates this year – and it affects all aspects of health care. More

Liberalism Explained

In the early 20th century, they called themselves “progressives.” Then, they were “liberals.” Now they are “progressives” again. Early on, they embraced racism and endorsed eugenics. Then they became advocates for civil rights. Now they endorse racism of a different sort – wokeness. If you had to the describe the distinguishing characteristic of modern liberalism, what would your answer be? John Goodman gives a novel answer. More

The Inflation Tax

With 10% inflation, the average family can expect to lose 7% of its lifetime income to government.

This is the startling conclusion of a first-ever study by Laurance Kotlikoff and Alan Auerbach and their colleagues. The sources of the loss: (1) large parts of the tax code are not inflation indexed, (2) those parts that are indexed are indexed with a lag, and (3) Social Security benefits and other entitlements are also indexed with a lag. Our fiscal system is so incredibly complex that it has been impossible to measure the overall effects of inflation before now. Given the 20 largest federal/state entitlements, all administered differently by 50 states, that gives us 1,000 fiscal systems– to say nothing of all the different tax regimes. Hats off to the economists who spent several years developing the model that could give us a reliable answer. See John Goodman’s explanation of the study at Forbes.

We’re Not Saving Enough

Americans don’t save enough, either individually or collectively. Yet by looking at the wrong data, many journalists and even top economists are claiming we’re experiencing a “savings glut.” This is hogwash. It’s time to talk turkey about U.S. saving and for journalists and professionals to either do their homework or hold their pens. More

How Congress Can Help Protect Us from Inflation

The inflation rate is the highest it’s been in 40 years. Congress can’t change that. But there are six things it can do to help all of us weather inflation, beginning with full inflation indexing of the tax code.

Could We Talk Ourselves into A Recession?

Congress should take this opportunity to make the tax system fully inflation-neutral. But neither inflation nor the Fed’s minor rate hikes will kill the economy. Nor will Putin’s war, which is stimulating the defense industry. Nor will ongoing slowdowns in Chinese production, which is stimulating home production. What can kill the economy is enough people, who should know better, talking it down.

Is Social Security Sexist?

Theft is a strong word. So, take it from Social Security’s own Inspector General (IG), whose 2018 report estimates that Social Security wrongfully deprived over 13,000 widows and widowers of $132 million and counting! More

Protecting Seniors from Inflation

Congress should do three things: (1) index the Social Security benefits tax, (2) let inflation indexed government bonds also index against inflation-induced higher taxes, and (3) let people exchange their non-indexed pensions for an inflation-indexed alternatives. More.

Your Home is a Great Hedge Against Inflation

Buy now. Houses, like most physical assets, retain their real value during high inflation and have done far better than most such assets. Plus, if you buy a primary residence now and home prices fall, you won’t be affected unless you need to sell. As long as you have a stable job, can manage your mortgage, and don’t need to move anytime soon, a short-term drop in housing prices isn’t a concern.

Why “Testing to Treat” for Covid Isn’t Working

We now have wonderful new drugs to treat COVID. Paxlovid, produced by Pfizer, is an example. But half of these medications aren’t being prescribed. Indeed, many go to waste, sitting on the shelves of pharmacies until their expiration dates. More…

Solution for Student Debt

Let students and parents borrow as well as refinance their loans at the prevailing Treasury’s 30-year bond rate. This policy coupled with the ability to discharge student loans in bankruptcy will end the student loan crisis. More

Social Security Benefits: Heads They Win, Tails You Lose

One disabled lady was clawed back for over $300,000 for a mistake that Social Security admitted in writing was theirs! If she doesn’t repay, Social Security will almost always stop sending people like her a single penny until they pay “what they owe.” This can take years or decades. More

House Republicans – Raise the Debt Limit, But Stick to Your Fiscal Guns. Our Country Is Dead Broke!

Our country’s fiscal gap is 7.7 percent of GDP. This means we need to collect 7.7 percent more in taxes, every year starting now, to cover all the future spending the CBO projects. Alternatively, we need to immediately and permanently lower the path of federal spending by 7.7 percent of each future year’s GDP. Or we can do neither of these things and dig an even deeper hole for our kids. More

What the Debt Deal Ignored

A month ago, Social Security’s Trustees published their annual report. Table VIF1, buried deep in the Appendix, where no one looks, is the statement that Social Security’s unfunded liability is $66 trillion. This measure of Social Security’s red ink is not just gargantuan on its own. It’s $13 trillion larger than it was just three years ago. More

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Why California Needs Higher Prices for Water

California’s extreme drought will force rationing of water or higher prices, say John McKenzie and Richard McKenzie. Raising water prices has a great advantage: “Higher water prices can increase the state’s available water supply—without additional rainfall or...

Should We Even Try to Recycle Plastics?

Pressuring plastic producers to recycle their products has gone on for decades. But two writers at the Atlantic have now concluded, “Plastic recycling does not work and will never work.” In the U.S. in 2021 only 5 percent of all post-consumer plastic was recycled. Furthermore, they say that the plastic producers deny this and those denials are “reminiscent of” the tobacco companies in making false claims. (For years, many tobacco firms rejected the idea that cigarettes caused cancer.)

The “Madness of Crowds”?

Can history help us understand today’s panic over global warming? While the Earth is warming and human activity is probably contributing to it, the overheated efforts to make people fear the long-term future suggest that this is more of a crusade than a rationally considered enterprise. Extreme fear of global warming is negatively affecting politics, the economy, the media, international relations, and education.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Saving on CNBC: FED is holding 20% of federal debt

The Federal Reserve System is holding 20% of the federal government’s publicly held debt. It also is holding a lot of bank reserves. For every dollar of required reserves, banks have deposited $12 at the FED.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

How Obamacare Made Things Worse for Patients With Preexisting Conditions

One of the strange features of the national health care conversation is how it has evolved. What is often referred to as Obamacare began as an attempt to insure the uninsured. In fact, the initial Congressional Budget Office estimates predicted the Affordable Care Act would be largely successful in doing just that. Yet it was the Senate’s Democratic leader, Chuck Schumer of New York, who identified the political problem with that goal early on. About 95% of those who vote already have insurance, Schumer noted. So Obamacare was promising to spend a great deal of money on people who don’t vote.

Response to Coronavirus Reflects Trump’s Plan to Radically Reform Health Care

Critics of President Trump’s response to the coronavirus crisis characterize it as knee-jerk, spur-of-the-moment, and grasping at any straw within reach. In fact, many of the executive actions we have seen in the past few days reflect a new approach to health policy that has been underway almost since the day Donald Trump was sworn into office.

The 60 Percent Solution to Reforming Healthcare

Can we transform the entire health care system by empowering the roughly 60 percent of patients who are in private health plans? That’s the premise of a new book I just read by Todd Furniss (@TFurniss on Twitter). The author ofThe 60% Solution: Rethinking Healthcare, believes there are five major reforms necessary to empower patients and help them get better care at better prices. These include: (1) change governance, (2) modify health savings accounts (HSAs), (3) clear prices, (4) standardize accounting and information technology in the medical industry and (5) emphasize primary care.

Does Lack Of Health Insurance Kill?

The Republican health plan will kill people,” says Bernie Sanders. “The Republican Party is the party of death,” says the headline at Political dig.

Gorman at Forbes: Risk Pools Work Better Than Obamacare

Risk pools were not perfect. But they worked much better than the individual market today. Prior to Obamacare, for example, premiums tended to be less than half of current ones, networks were large, and carriers offered such a variety of policies that there was something available to fit most family budgets.

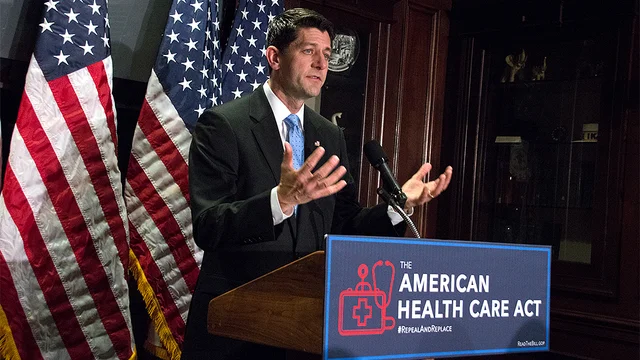

Why the Republican Version of ObamaCare is a Sham

The people who crafted the Republican ObamaCare reform bill seem to want to help. They promise other reforms will be coming. Trust us, they say, we’re from the (new) government, and we’re here to help.

Why the Republican version of ObamaCare is a sham

The people who crafted the Republican ObamaCare reform bill seem to want to help. They promise other reforms will be coming. Trust us, they say, we’re from the (new) government, and we’re here to help.

Will Colorado Vote to Socialize Its Health Care System?

When the rest of the nation goes to the polls in November, residents of Colorado will vote on Amendment 69. If it passes, they will give a government body called ColoradoCare virtually complete control over all health care in the state.

Gorman in The Hill: Doctor Incentives Rx is Failing

The Medicare Payment Advisory Commission has voted to recommend scrapping the Merit-Based Incentive Payment System because it “cannot succeed.”

Gorman in Forbes: Will Tax Reform Kill People?

You know you are in the silly season when the charges against sensible tax reform become more and more outrageous. The silliest and most outrageous is based on this causal reasoning: The Republican tax measure repeals the Obamacare mandate, requiring people to purchase health insurance; without the mandate, fewer people will insure; and without insurance, more people will die.

Gorman: US Hospitals are Safer

A frequent criticism of US hospitals is the charge of excessive adverse medical events, sometimes leading to avoidable deaths. How do our hospitals compare to hospitals in national health care systems? Quite well. The percent of patients who experience an adverse event is twice as high in Canada, three times as high in Britain and four times as high in New Zealand.

Four More Years?

If you think the first Obama term has been bad, just wait. Commentary by Pete du Pont May 28, 2012 Source: The Wall Street Journal Before being elected in 2008, Barack Obama said: "We are five days away from fundamentally transforming the United States of America."...

A Choice, Not an Echo

There are big differences between Barack Obama and Mitt Romney Commentary by Pete du Pont April 29, 2012 Source: The Wall Street Journal As the presidential election is just over six months away and both parties have chosen their candidates, the campaign is now fully...

The Anti-Energy President

He really meant it when he said prices would "skyrocket." Commentary by Pete du Pont March 29, 2012 Source: The Wall Street Journal Our America today is very different from the America of some years ago. Government spending is greatly increased, as is the regulation...

The Pros and Cons of Hillary

Why she might want to run for vice president—and why she might not. Commentary by Pete du Pont January 31, 2012 Source: The Wall Street Journal "Look, it's the one thing, I think, that the Democrats could do to nearly guarantee Obama re-election," Bill Keller of the...

President Obama’s Slip

Pete du Pont explains what President Obama’s slip in the polls means to the GOP hopefuls. Commentary by Pete du Pont December 27, 2011 Source: Wall Street Journal The Iowa Republican presidential candidate debate was very well done. Fox News people had good questions,...

Bye Bye Biden?

Why Obama may be eyeing Mrs. Clinton for the 2012 ticket. Commentary by Pete du Pont November 25, 2011 Source: Wall Street Journal The coming political year, with presidential, House and Senate elections, will be one of the most interesting (and important) ones we...

No More Years

No More Years Commentary by Pete du Pont October 21, 2011 Source: Wall Street Journal Just two years ago it seemed highly unlikely that Barack Obama would turn out to be a one-term president. But looking at voters' frustrations with our continuing economic problems...

More of the Same Old Change

Obama's latest economic proposals are just like the earlier ones, only worse. Commentary by Pete du Pont September 30, 2011 Source: The Wall Street Journal In the last few years, as promised, the Obama administration has fundamentally transformed America. Our country...

Obama’s Anti-Energy Agenda

He threatens to cut off the fuel the economy needs. Commentary by Pete du Pont July 01, 2013 Source: The Wall Street Journal Not surprisingly, President Obama and Speaker John Boehner have different views on energy policy, differences brought into stark contrast by...

Obama’s Scandalous Legacy

He has given Americans new reason to distrust the government. Commentary by Pete du Pont May 28, 2013 Source: The Wall Street Journal It's too early to tell if May will be remembered as marking the beginning of a failed second term for President Obama, but it is clear...

The Great Destroyer

ObamaCare wreaks havoc on health care, the economy, American freedom and Obama's presidency. Commentary by Pete du Pont November 25, 2013 Source:The Wall Street Journal Polls show an increasing majority of Americans dislike President Obama's healthcare law and...

How to Reform Social Security

The key to reform is to make today’s retirees positive beneficiaries of reform.

A golden opportunity to do so exists for two reasons: (1) the current system is abusing senior retirees in myriad ways, and (2) many of these abuses can be eliminated without any cost to the Treasury. In other words, some aspects of responsible reform are a free lunch.

California Dreaming

California legislators want the state to provide free health care to every resident, including undocumented immigrants. Under the act, it would be illegal for any resident to pay a doctor privately for any medical treatment covered by CalCare. John Goodman and Linda Gorman predict higher taxes, less choice, an exodus of doctors and nurses out of the state, rationing by waiting, and something actually worse than Medicaid for all. See our editorial in the Orange County Register.

More Important Than the Industrial Revolution

It’s called the Transportation-Communication Revolution. In recent times, shipping costs have fallen by 50 percent and air cargo costs have fallen by almost 100 percent. As a result, the per capita GDP of developing countries (outside of sub-Saharan Africa) between 1960 and 2015 rose a whopping 549 percent.

What’s Wrong with the US Welfare State?

The bottom fifth of households in 2017 had an average (after tax and after entitlement spending) income of $33,653 per person. Almost all of this “income” is in the form of noncash welfare benefits. If all those benefits were converted into cash, a family of four in the bottom fifth of the (earned) income distribution would have $134,652 a year to spend, after taxes! The bottom fifth also had more per capita “income” than the next fifth and the middle fifth. To answer the question, “What’s Wrong?” I really shouldn’t have to say anything more. But, I did find a few more things to say in my most recent post at Forbes.

What To Do About Our Biggest Health Care Problems

Short-term health insurance and indemnity insurance are meeting needs not met by Obamacare. You would appreciate why that is a good thing if you understand:

Goodman’s Rule for Rational Public Policy: Let the markets handle all the problems markets can solve; and turn to government only to meet needs that competitive markets cannot or do not meet.

Biden v. Medicare Advantage

When does the failure to answer a phone call in 8 seconds cost the company receiving the call $190 million? When the caller is a spy working for the agency that runs Medicare and the receiving entity is a private insurance company. More.

Leftists in Colorado Seem Poised to Try Again for Single Payer Health Insurance

Last time around, the idea was rejected by almost 79% of the voters. And for good reasons. British Columbia’s single payer system is so mismanaged it pays for cancer patient radiation treatments in Bellingham, Washington. Its hip replacement wait can be almost a year… Because Canadian patients wait twice as long as recommended for MRI scans, those who can afford it pay cash for quick service at US imaging centers in border cities like Buffalo, NY and Bellevue, WA. More.

Two Cheers for the Bipartisan Tax Deal

A rare bipartisan agreement in Congress would create a larger child tax credit for parents and extend some key business tax breaks in the 2017 (Trump) tax reform bill that have expired. Democrats are said to favor the former and Republicans the latter.

Opinions on the accord are all over the map, with pros and cons – both on the right and the left. I give it two cheers. If it were funded by reducing means-tested welfare spending, I would give it a third cheer.

Social Security Claws Backs $34K from a Disabled Blind Worker for “Overpayments” Going Back 23 Years!

Social Security sends out more than 2 million clawback letters every year. Why so many clawbacks? Simple. Social Security doesn’t have the data it needs to correctly calculate benefits for tens of millions of us. Or it has the information on day 1, but doesn’t process it. Or it inputs the wrong information. Or it mixes up your earnings record with someone else’s. Or it makes the wrong benefit calculations. I’ve seen all of this and more. More

Medicare Spending Forecast

Bad as the Trustees Report is, the reality is likely to be ever worse.

Source: James Capretta, AEI

Inflation is a Hidden Tax

A new study lays out the toll of lifelong high inflation on consumers. It estimates that permanent 5% inflation would lower household lifetime spending by 3.62%. Permanent 10% inflation would lower lifetime household spending by 6.82%. Even if inflation ran permanently at the Fed’s 2% target, consumers would still feel a pinch, with a 1.5% reduction in lifetime household spending. More.