- John Goodman

- Larry Kotlikoff

- Jane Shaw Stroup

- Thomas Saving

- Devon Herrick

- Linda Gorman

- Pete Du Pont

- All Posts

What’s Wrong with the US Welfare State?

The bottom fifth of households in 2017 had an average (after tax and after entitlement spending) income of $33,653 per person. Almost all of this “income” is in the form of noncash welfare benefits. If all those benefits were converted into cash, a family of four in the bottom fifth of the (earned) income distribution would have $134,652 a year to spend, after taxes! The bottom fifth also had more per capita “income” than the next fifth and the middle fifth. To answer the question, “What’s Wrong?” I really shouldn’t have to say anything more. But, I did find a few more things to say in my most recent post at Forbes.

What To Do About Our Biggest Health Care Problems

Short-term health insurance and indemnity insurance are meeting needs not met by Obamacare. You would appreciate why that is a good thing if you understand:

Goodman’s Rule for Rational Public Policy: Let the markets handle all the problems markets can solve; and turn to government only to meet needs that competitive markets cannot or do not meet.

Biden v. Medicare Advantage

When does the failure to answer a phone call in 8 seconds cost the company receiving the call $190 million? When the caller is a spy working for the agency that runs Medicare and the receiving entity is a private insurance company. More.

Two Cheers for the Bipartisan Tax Deal

A rare bipartisan agreement in Congress would create a larger child tax credit for parents and extend some key business tax breaks in the 2017 (Trump) tax reform bill that have expired. Democrats are said to favor the former and Republicans the latter.

Opinions on the accord are all over the map, with pros and cons – both on the right and the left. I give it two cheers. If it were funded by reducing means-tested welfare spending, I would give it a third cheer.

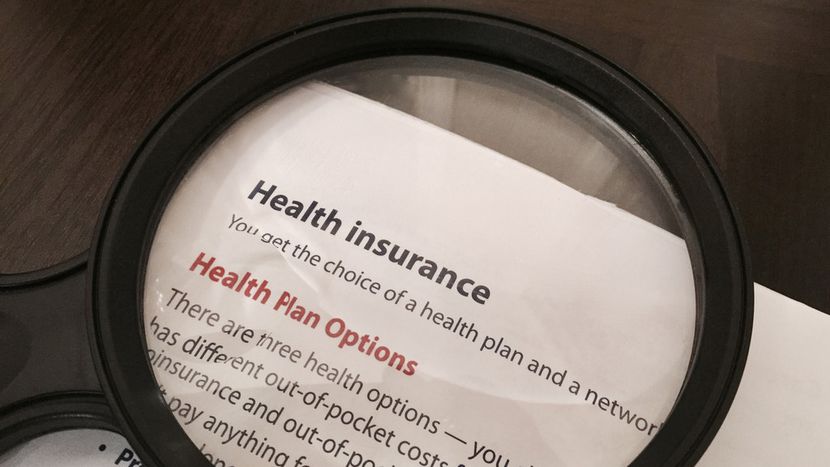

What Are We Getting for All That Obamacare Spending?

Obamacare spending has now reached $214 billion a year, insuring people through Medicaid (which is mostly contracted out to private insurers) and the Obamacare exchanges. At $1,731 for every household in America, that’s a great deal of money being transferred from taxpayers to insurance companies every year.

So, what are we getting in return?

One scholarly study finds there has been no overall increase in health care utilization in the U.S. since the enactment of Obamacare. The number of doctor visits per capita actually fell over the last decade.

See my latest post at Forbes.

Can We Reduce Health Care Costs with Better Primary Care?

A typical doctor’s office is quite spartan. The seating is usually austere. The flooring is low-budget (if there is carpeting, it is probably worn). And there are no free drinks or free food. If there is a restroom, it is probably located somewhere else in the building. More.

Washington Doesn’t understand Obamacare

In the House of Representatives, the GOP’s “number-one priority for health care reform” is lowering health insurance premiums. However, the vast majority of folks who buy their own insurance are getting hefty subsidies. So much so, that 8 in 10 enrollees in the exchanges pay $10 a month or less. For a family with average income, the premium is usually zero. More.

ObamaCare still desperately needs fixing

The American Rescue Plan injects new life into ObamaCare with more generous subsidies, expanded eligibility and premium limits that make insurance more affordable. Unfortunately, the stimulus proposal just passed by Congress does nothing to correct the most serious...

Identity Politics Explained

Racism is the lowest form of collectivism. Ayn Rand once called it “barnyard collectivism.” Throughout history, it has usually been the handmaiden of every other form of collectivism. In the modern world, collectivists are no longer able to make a serious argument for economic collectivism (socialism, fascism, communism, etc.) So, they have resorted to identity politics instead. More.

What Does the Left Have Against Au Pairs?

Au pairs represent a potential solution to two huge problems: the high cost of child care and the high cost of elder care. Young European women get free room and board, some spending money and a chance to experience America. So why does the Biden administration want to price them out of the market? More.

Common Sense as Health Policy

America is thought to have a market economy. Yet it is striking to consider all of the ways our health-care system prevents the market from solving our health-care problems.

Since most of the restrictions were created by Democratic legislation, it is tempting to view the liberation of health care as a Republican project. But there is no reason that it couldn’t be bipartisan. Here are several principles to guide reform.

The US is a Waning Economic Superpower

The U.S. is a waning economic hegemon. But far too few Americans, including politicians, realize this. The eventual new and very big kid on the block is, under all but extreme scenarios, China; and, after China, India. By 2100, the U.S. will be in third place, when ranked by GDP — producing only 12 percent of global output compared with China’s 27 percent and India’s 16 percent. More

The Republicans Need Their Own Student Loan Reform. Here It Is.

President Biden just canceled a mother-load of student debt. The income limit for the President's largess is $125,000 for individual borrowers and $250,000 for married and heads of households. Those below these limits received up to $10,000 in debt forgiveness. And...

Finally, A Safe Way To Play The Market — Upside Investing

Upside Investing represents a revolution in investment/spending strategy. It lets you set a living standard floor that only rises as a result of investing in stocks and other risky assets. The higher your floor, the lower your upside and vice versa.

Inequality has been Greatly Exaggerated

A new study by Goodman Institute Senior Fellow Laurence Kotlikoff and his colleagues says that middle-aged families in the top fifth of the income distribution have almost 200 times the wealth of families in the bottom fifth. But after taxes and entitlement transfers, the difference in lifetime spending power is only 7.5 to 1. Our fiscal system is far more progressive than critics like to admit. See the New York Times description and the technical paper.

We’re Not Saving Enough

Americans don’t save enough, either individually or collectively. Yet by looking at the wrong data, many journalists and even top economists are claiming we’re experiencing a “savings glut.” This is hogwash. It’s time to talk turkey about U.S. saving and for journalists and professionals to either do their homework or hold their pens. More

How Congress Can Help Protect Us from Inflation

The inflation rate is the highest it’s been in 40 years. Congress can’t change that. But there are six things it can do to help all of us weather inflation, beginning with full inflation indexing of the tax code.

Could We Talk Ourselves into A Recession?

Congress should take this opportunity to make the tax system fully inflation-neutral. But neither inflation nor the Fed’s minor rate hikes will kill the economy. Nor will Putin’s war, which is stimulating the defense industry. Nor will ongoing slowdowns in Chinese production, which is stimulating home production. What can kill the economy is enough people, who should know better, talking it down.

Is Social Security Sexist?

Theft is a strong word. So, take it from Social Security’s own Inspector General (IG), whose 2018 report estimates that Social Security wrongfully deprived over 13,000 widows and widowers of $132 million and counting! More

Social Security’s Massive Malfeasance

Social Security has committed and continues to commit huge fraud against 13,000 plus widow(er)s who collectively have been swindled out of $130 million. Those are the figures of Social Security’s own Inspector General. More

America’s Fiscal Gap

That’s the difference between the federal government’s spending commitments and its income – looking indefinitely into the future. Closing the gap through time requires an immediate and permanent 41.3 percent increase in all federal taxes or an immediate and permanent 35.3 percent cut in all non interest federal spending. More

The Government’s New Tax Break for Retirees is Less Than Meets the Eye

QLACs — Qualified Longevity Annuity Contracts promise to be “A Retirement Tax Break That Ends the Fear of Outliving Your 401(k).” But while buying a QLAC lowers the person’s exposure to one major risk (living too long), it raises exposure to another risk: inflation. More

Student Loans: A ‘National Catastrophe’

Review of The Debt Trap: How Student Loans Became a National Catastrophe, by Josh Mitchell (New York: Simon & Schuster, 2021) 261 pp.

Going Against the Grain

In 1973, John Baden and Richard Stroup proposed selling off the U. S. Forest Service to private owners, some nonprofit and some for-profit. In an article in the Journal of Law and Economics, they argued that commercial timber would be better managed by private companies, and non-profit organizations like the Sierra Club could protect the important environmental areas.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Can There Be Too Many Trees?

Drought-resistant trees are replacing grasslands around the world, and, specifically in the western United States. This is a problem? More.

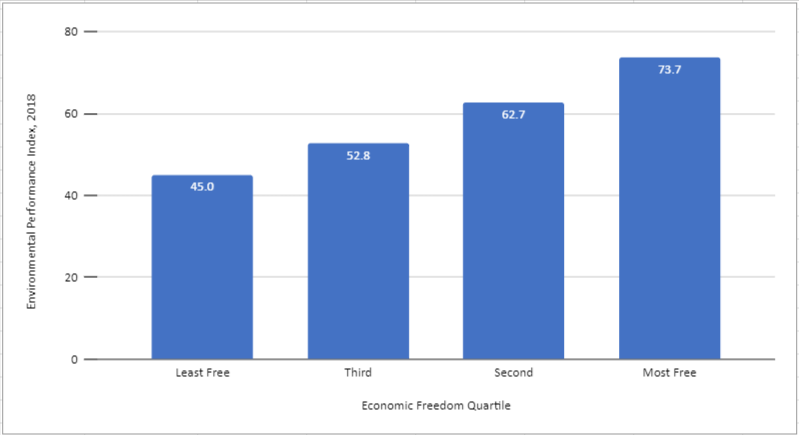

Economic Freedom IS good for the environment

Yes, data from the Yale Center for Environmental Law & Policy and the Fraser Institute’s Economic Freedom of the World Index send a resounding message: Economic freedom brings about environmental protection. Why? Because economic freedom leads to prosperity and only prosperous countries can truly protect their environment. Are you skeptical? More.

Julian Simon, Vindicated Again

Each year, the Competitive Enterprise Institute (CEI) has a dinner in Washington, D.C., honoring the economist Julian Simon, who died in 1998. Simon was a rare optimist in the fields of population and natural resources. He disagreed with most environmentalists of his day (especially in the 1980s through 1990s). They feared passionately that growing population would overwhelm agriculture and industry and that the world would run out of natural resources such as oil and minerals.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

The Federal Reserve’s Accountability Deficit

The Federal Reserve enjoys extraordinary independence from the elected branches of government, based on the well-founded fear that politicians cannot be trusted with the power to print money and manipulate interest rates.

Goodman and Saving: Budget Deal’s Trillion Dollar Surprise

The most significant federal entitlement reform in our lifetime was a little noticed provision that Democrats included in the Affordable Care Act. The provision was a cap on Medicare spending, similar to the cap Republicans proposed for Medicaid last summer.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

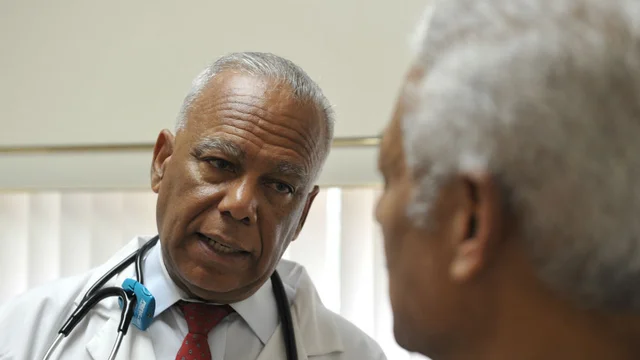

Herrick: Future Pandemics Require Better Access to Primary Care

When Americans become ill or have a health complaint, they often schedule an appointment with a primary care provider (PCP). PCPs are often the first line of defense in the battle against the onset of seasonal outbreaks of colds, flu or more serious problems like COVID-19.

Herrick: Could Free-Market Medicine Respond Better to Pandemics?

Many people have come to believe that the only way to protect Americans against future pandemics is to turn over control of our health care system to the government. The folly of this view was apparent when the U.S. Centers for Disease Control & Prevention (CDC) utterly failed as the monopoly supplier of COVID-19 diagnostic testing kits. When the first cases appeared, about half of the test kits failed and replacements were slow in coming.

Health Reform: There Is Something for Everyone to Love… and Hate

Why is it controversial to expand the physician supply, creating more competition? Doctors oppose it, just like they oppose expanding the scope of practice for nurse practitioners. Doctors don’t want me to be able to see a nurse practitioner or physician assistant for a wart on my toe unless that NP/PA works for them.

How did doctors get so powerful? In the first half of the 20th Century, the American Medical Association (AMA) waged a largely successful battle to close medical schools that trained competing physicians. …. More than half of American and Canadian medical schools were closed…. Thus, the job of a physician was yanked out of reach of all but the smartest, most disciplined, wealthy elites.

Gorman: We can cover those with pre-existing conditions without Obamacare

There are many ways to provide medical care for people with pre-existing conditions. Real world experience shows that some work better than others. Properly structured stand-alone high risk pools and medically underwritten individual health policies guaranteed coverage for more than a decade before ObamaCare.

Individual Insurance Buyers Were Better Off Without Obamacare

Obamacare’s destruction of the individual health insurance market has done enormous damage to the lives and finances of millions of people who purchase their own insurance.

ObamaCare has Failed Patients with Pre-Existing Conditions

There are many ways to provide medical care for people with pre-existing conditions. Real world experience shows that some work better than others.

ObamaCare has failed patients with pre-existing conditions

There are many ways to provide medical care for people with pre-existing conditions. Real world experience shows that some work better than others.

Does Lack Of Health Insurance Kill?

The Republican health plan will kill people,” says Bernie Sanders. “The Republican Party is the party of death,” says the headline at Political dig.

Gorman at Forbes: Risk Pools Work Better Than Obamacare

Risk pools were not perfect. But they worked much better than the individual market today. Prior to Obamacare, for example, premiums tended to be less than half of current ones, networks were large, and carriers offered such a variety of policies that there was something available to fit most family budgets.

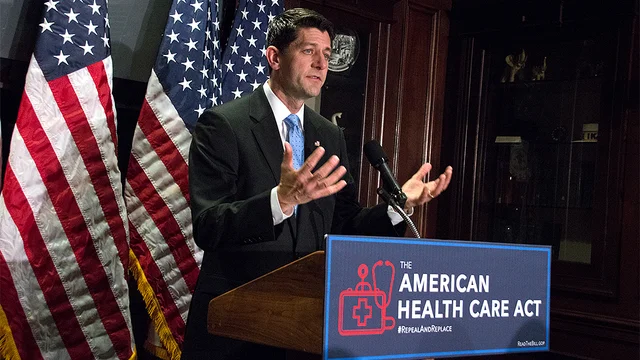

Why the Republican Version of ObamaCare is a Sham

The people who crafted the Republican ObamaCare reform bill seem to want to help. They promise other reforms will be coming. Trust us, they say, we’re from the (new) government, and we’re here to help.

Why the Republican version of ObamaCare is a sham

The people who crafted the Republican ObamaCare reform bill seem to want to help. They promise other reforms will be coming. Trust us, they say, we’re from the (new) government, and we’re here to help.

Linda Gorman Study: Obamacare Dollars Wasted

The percent of the population with private health insurance actually declined during the eight years of the Obama presidency, according to a study by health economist Linda Gorman.

Gorman: Obamacare has been extremely wasteful

The federal government spent $341 billion from 2014 through 2016 on subsidizing individual coverage so that people would buy it (Not counting the money spent on state and federal exchanges).

The $3.5T Spending Mistake

Congressional Democrats are proposing to spend an enormous amount of taxpayer dollars on what the New York Times calls a “cradle to the grave” addition to U.S. social welfare. When budgeting shenanigans are ignored, the Committee for a Responsible Federal Budget estimates that the full cost is not the $3.5 trillion that has been widely advertised, but at least $5.0 trillion and possibly as much as $5.5 trillion.

Focus on Fundamentals

The current economic debate is an exercise in missing the point. Commentary by Pete du Pont December 30, 2012 Source: Wall Street Journal "If we're going to raise revenue and if we're going to raise it in any form, then we darn well better cut spending, because...

Hello, Europe

On its current trajectory, America will look like France or Greece before long. Commentary by Pete du Pont November 22, 2012 Source: Wall Street Journal The election is behind us, with President Obama's strong victory over Mitt Romney. Mr. Obama did not do as well...

Will America Abandon ‘Hope’?

As the election approaches, most voters think the country is on the wrong track. Commentary by Pete du Pont July 29, 2012 Source: The Wall Street Journal The presidential campaign remains very close, but some of the polling information must continue to cause alarm in...

Class Struggle

On education, there are big differences between Obama and Romney. Commentary by Pete du Pont June 27, 2012 Source: The Wall Street Journal Much has been written about the choice we face just 19 weeks from now, when we will select the next president. But while we...

Four More Years?

If you think the first Obama term has been bad, just wait. Commentary by Pete du Pont May 28, 2012 Source: The Wall Street Journal Before being elected in 2008, Barack Obama said: "We are five days away from fundamentally transforming the United States of America."...

A Choice, Not an Echo

There are big differences between Barack Obama and Mitt Romney Commentary by Pete du Pont April 29, 2012 Source: The Wall Street Journal As the presidential election is just over six months away and both parties have chosen their candidates, the campaign is now fully...

The Anti-Energy President

He really meant it when he said prices would "skyrocket." Commentary by Pete du Pont March 29, 2012 Source: The Wall Street Journal Our America today is very different from the America of some years ago. Government spending is greatly increased, as is the regulation...

The Pros and Cons of Hillary

Why she might want to run for vice president—and why she might not. Commentary by Pete du Pont January 31, 2012 Source: The Wall Street Journal "Look, it's the one thing, I think, that the Democrats could do to nearly guarantee Obama re-election," Bill Keller of the...

Obama’s Foreign Failure

The world hasn't lived up to his Pollyannaish expectations. Commentary by Pete du Pont August 27, 2013 Source: The Wall Street Journal Barack Obama entered the White House with the promise of restoring our nation's standing in the world. Suffering from war fatigue and...

Second-Term Nightmare

ObamaCare's chickens come home to roost. Commentary by Pete du Pont July 27, 2013 Source: The Wall Street Journal Talk about being between a rock and a hard place. The Obama administration and its allies in Congress are faced with the challenge of trying to convince...

Our Gravest Peril

ObamaCare? Stagnant economy? Crushing debt? Foreign policy fecklessness may trump them all. Commentary by Pete du Pont January 21, 2014 Source: Wall Street Journal America's most worrisome problem may not be the failed takeover of our healthcare system. It may not be...

Is There a Trump Health Care Plan?

Although he rarely talks about it, the most significant gift Donald Trump bequeathed to economic prosperity was deregulation. And the one sector that was deregulated more than any other was health care. Since Joe Biden has been re-regulating the economy, it’s hard to think of a starker contrast between the two leading presidential candidates this year – and it affects all aspects of health care. More

Liberalism Explained

In the early 20th century, they called themselves “progressives.” Then, they were “liberals.” Now they are “progressives” again. Early on, they embraced racism and endorsed eugenics. Then they became advocates for civil rights. Now they endorse racism of a different sort – wokeness. If you had to the describe the distinguishing characteristic of modern liberalism, what would your answer be? John Goodman gives a novel answer. More

Social Security Reform, Part II

To get seniors to support Social Security reform, there are additional abuses that need correcting. These include: stopping the double taxation of senior income through the Social Security benefits tax, no longer forcing seniors to dissave, abolishing the Social Security earnings penalty, and ending taxation by inflation. More

Obamacare Exchanges at Age Ten

March 23rd will mark the 14th anniversary of the Affordable Care Act, and it is now ten years since the creation of the Obamacare exchanges. There are three ways to look at Obamacare today: in terms of (1) what the Obama administration said it was about, (2) what policy wonks thought it was about, and (3) how it really works. More at my post at Forbes.

How to Reform Social Security

The key to reform is to make today’s retirees positive beneficiaries of reform.

A golden opportunity to do so exists for two reasons: (1) the current system is abusing senior retirees in myriad ways, and (2) many of these abuses can be eliminated without any cost to the Treasury. In other words, some aspects of responsible reform are a free lunch.

California Dreaming

California legislators want the state to provide free health care to every resident, including undocumented immigrants. Under the act, it would be illegal for any resident to pay a doctor privately for any medical treatment covered by CalCare. John Goodman and Linda Gorman predict higher taxes, less choice, an exodus of doctors and nurses out of the state, rationing by waiting, and something actually worse than Medicaid for all. See our editorial in the Orange County Register.

More Important Than the Industrial Revolution

It’s called the Transportation-Communication Revolution. In recent times, shipping costs have fallen by 50 percent and air cargo costs have fallen by almost 100 percent. As a result, the per capita GDP of developing countries (outside of sub-Saharan Africa) between 1960 and 2015 rose a whopping 549 percent.

What’s Wrong with the US Welfare State?

The bottom fifth of households in 2017 had an average (after tax and after entitlement spending) income of $33,653 per person. Almost all of this “income” is in the form of noncash welfare benefits. If all those benefits were converted into cash, a family of four in the bottom fifth of the (earned) income distribution would have $134,652 a year to spend, after taxes! The bottom fifth also had more per capita “income” than the next fifth and the middle fifth. To answer the question, “What’s Wrong?” I really shouldn’t have to say anything more. But, I did find a few more things to say in my most recent post at Forbes.

Do You Trust your Health Insurer?

Why do employers (including government employers) and insurers mistreat enrollees with costly health care problems? When the New York Times describes the abuses, you are encouraged to believe that the blame rests with private insurance. In fact, the source of the problem is perverse incentives created by bad government policies. More.

Letter to the Commissioner

Congratulations on limiting the amount by which a beneficiaries benefits may be clawed back because of Social Security ‘s own mistakes. More needs to be done however. More.

Riots over the Bible? Yes. In Philadelphia.

When we think of conflicts between Catholics and Protestants, we think of the wars following the Protestant Reformation in Europe in the 1500s and 1600s. The United States, we assume, has followed a policy of free expression of religion, as promised in the First Amendment to the U.S. Constitution. Sad to say, that is not true. I would like to share with you (briefly) the story of the “Philadelphia Riots of 1844.”