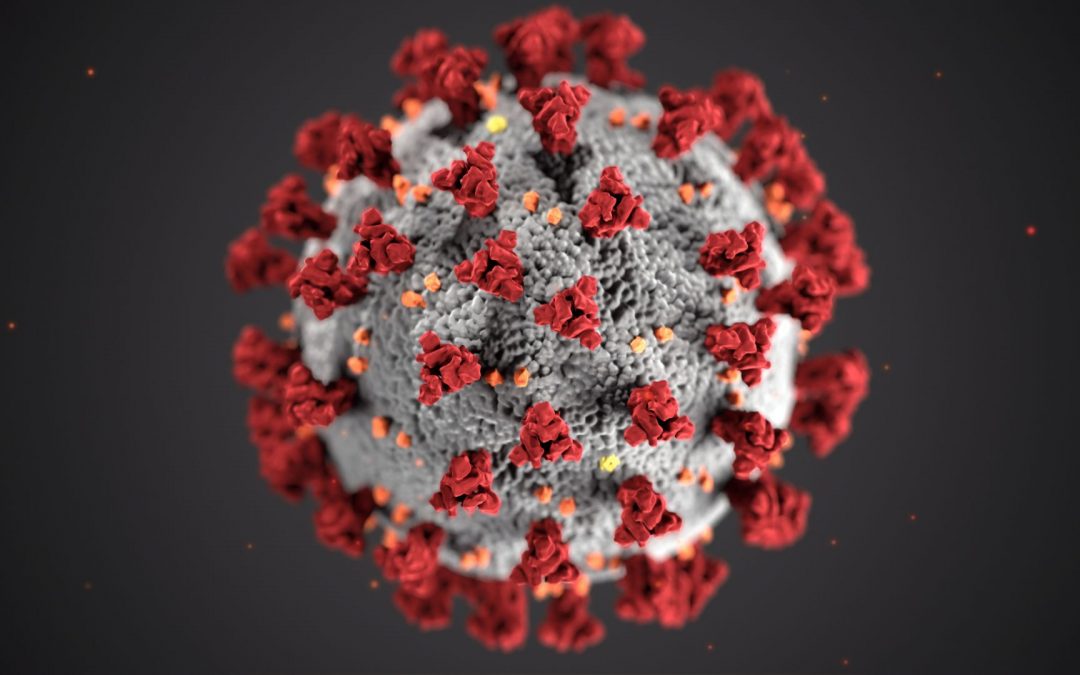

Critics of President Trump’s response to the coronavirus crisis characterize it as knee-jerk, spur-of-the-moment, and grasping at any straw within reach. In fact, many of the executive actions we have seen in the past few days reflect a new approach to health policy that has been underway almost since the day Donald Trump was sworn into office.

These include the ability to be diagnosed and treated without ever leaving your own home; the ability to talk to doctors 24/7 by means of phone, email and Skype; and the ability of the chronically ill to have access to free diagnoses and treatments without losing their access to Health Savings Accounts.