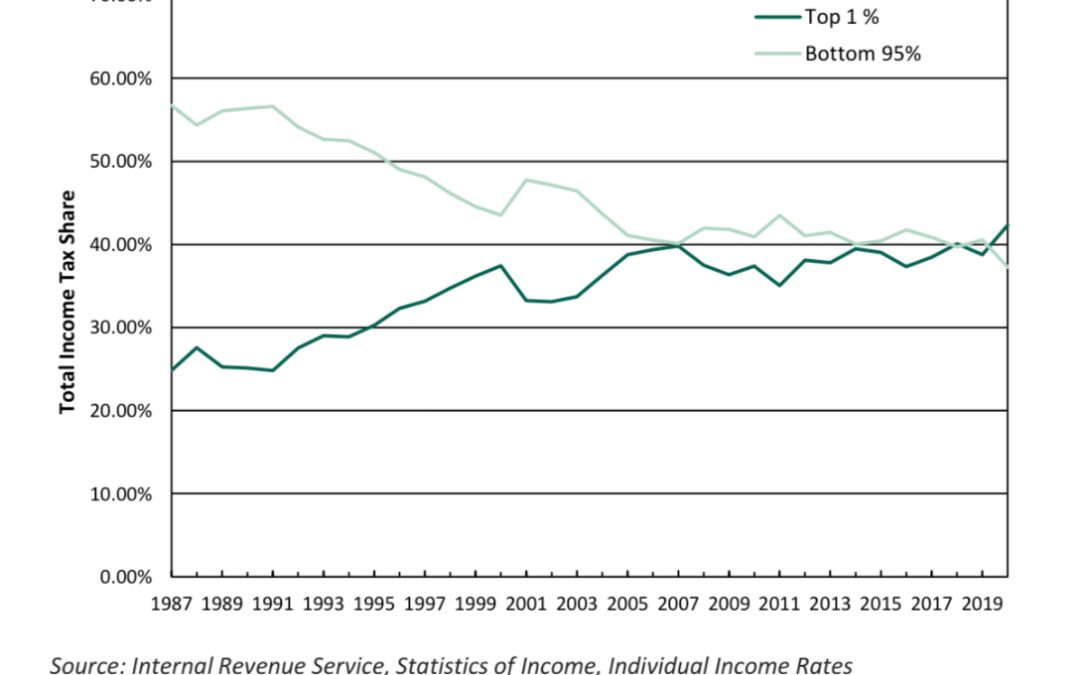

The latest IRS statistics tell the story. The richest one out of 100 Americans now pay more in federal income taxes than the bottom 95 out of 100. There is almost no country in the world that relies on the top 1% to pay a larger share of the tax burden than the United States. Notice that the tax share of the top 1% went UP after the Trump tax cuts.