Why do people save for retirement? Or buy life insurance? Or home owners and other kinds of insurance? In all cases the objective is the same: to smooth out life time consumption. We don’t want our normal consumption of goods and services to be interrupted by retirement or the myriad accidents that could befall us.

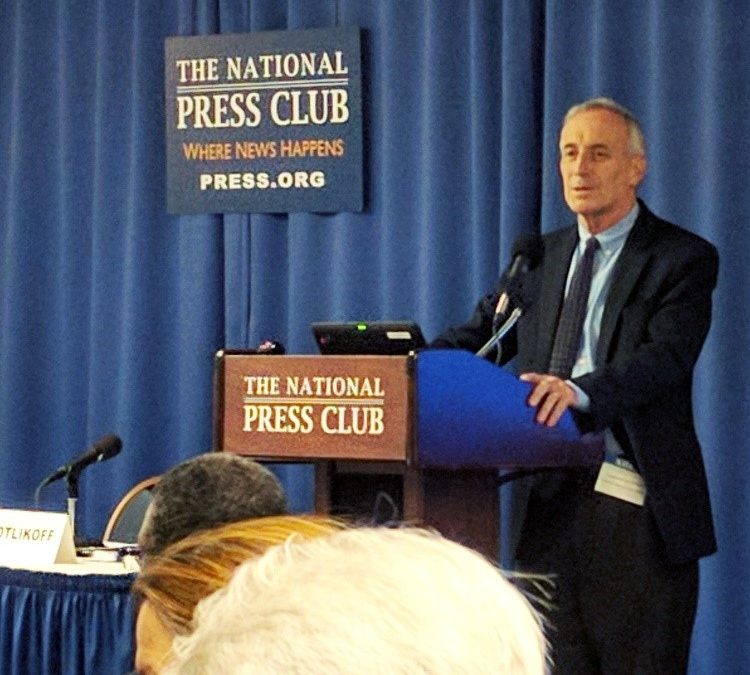

In the face of cash constraints, job market uncertainty and other uncertainties planning is very difficult, however. And it isn’t helped much by conventional financial advice. New breakthroughs in computer programming by Prof. Laurence Kotlikoff help solve these problems.